This information was published in the October 2021 issue of ProPrint, on behalf of ProPrint Awards Emerging 50 Foundation Partner – Media Super. To read the full magazine, please click here.

Many of us have multiple super accounts we’ve picked up as we changed jobs. Consolidating* your super is one of the most important steps you can take to make the most of your retirement income.

The sooner you consolidate your super into one account, the sooner you’ll stop paying unnecessary fees and have more to put towards your ideal retirement lifestyle.

By keeping all your super in one fund, you can maximise your compound returns because you’ll only be paying one set of fees and insurance premiums, meaning more of your money is invested and earning returns.

It’s easy to consolidate your super online without needing forms. Just log in to your Media Super account and follow the steps.

Remember to check your insurance cover or loss of benefits before closing accounts. Find out more about consolidating your super at www.mediasuper.com.au/fetch.

Search for any lost super

According to Treasuryˆ, there’s approximately $13.8 billion in lost or inactive super accounts in Australia.

Super often becomes lost when someone changes their name, address, joins a new fund or switches jobs. Lost super can be hard to avoid if you’ve worked several casual, freelance, and part-time jobs or moved around a lot.

If your super fund doesn’t have your current address and has been unable to contact you, and you’ve had no contributions or rollovers into your account in the last 12 months, your super must be treated as lost, and will then be reported to the ATO where they will try and match it to an existing super account.

If you think you might have lost super, find out how you can locate it via our website, mediasuper.com.au/lost.

Make personal contributions

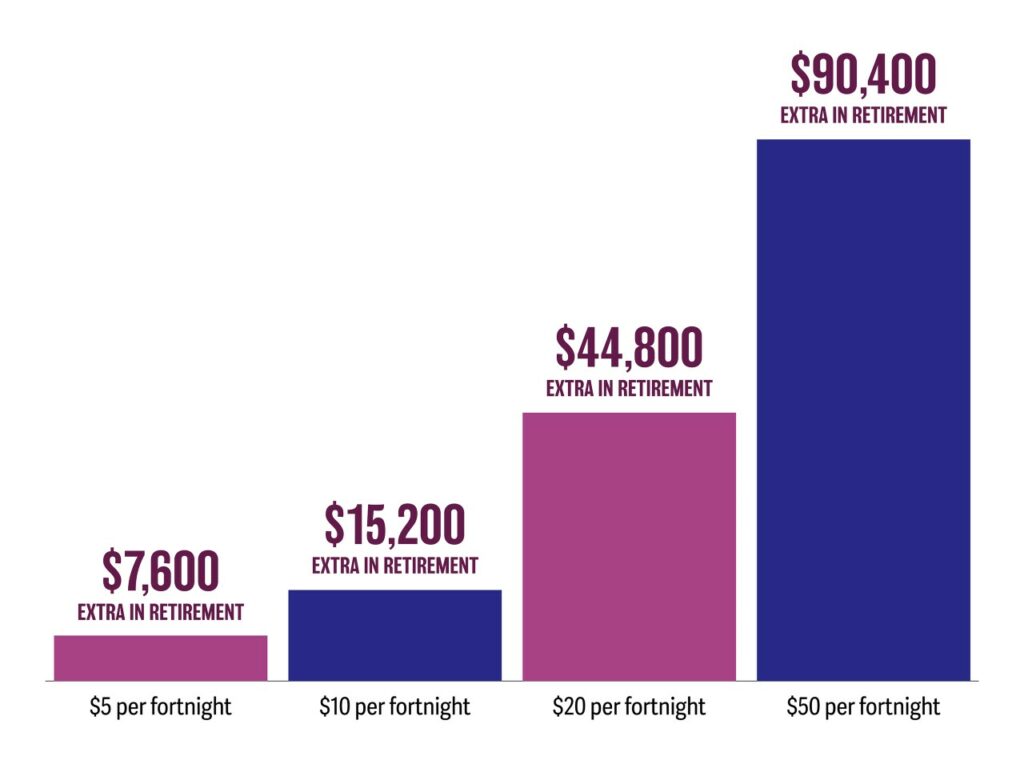

The bulk of your super will come from employer contributions but making even small personal contributions over time can make a big difference to your retirement savings.

Keep in mind that if you’re a freelancer or self-employed, you’re generally responsible for making your own super contributions.

Two easy ways to make contributions are:

• Salary sacrifice – an agreement with your employer to pay some pre-tax salary into your super

• Voluntary contributions – payments made after tax as a regular or one-off paymentIf you make personal contributions, you may be eligible for a government co-contribution, depending on your income. Your personal contributions are fully tax deductible.

Making contributions at any stage will help boost your balance; but because of compounding interest, contributions you make early in your working life will have a greater impact.

Use our online Contributions Optimiser Calculator to explore your options and see for yourself the difference personal contributions can make over time, mediasuper.com.au/calculators.

Our Helpline team can help you work out a customised contribution strategy that will maximise your contributions to help your super balance grow faster.

Know your investment options

If you haven’t made an investment choice, your money will most likely be in Media Super’s Balanced (MySuper) option.

Everyone has different investment needs based on your life stage, financial situation and how ‘hands on’ you want to be, so there may be a better option for you. Read through your available investment options and make the right choice for you.

Generally, when you’re younger, you may want to invest in growth options as you have a longer investment timeframe and usually can afford to take more risk. As you get older, you may gradually move to more conservative investments aimed at reducing volatility and preserving your balance.

Media Super has a wide range of investment options from pre-mixed options to single-asset options and a direct investment option. Find out more at mediasuper.com.au/investments

We are here to help

Media Super is committed to providing you with the right resources that help you achieve your retirement goals. If you have questions about your investment options, making contributions, or need account or transaction support, call the Helpline on 1800 640 886 between 8.00am and 7.00pm AEST/AEDT on weekdays.

Disclaimer

*Before making a decision to combine your superannuation, you should consider any costs, change to insurance cover or loss of benefits that may apply and, if necessary, consult a qualified financial adviser.

This article contains general information and does not take into account your personal objectives situation or needs. Before making any financial decisions about Media Super, you should first consider the Product Disclosure Statement at mediasuper.com.au/pds and read the relevant target market determination at mediasuper.com.au/tmd.

Issued October 2021 by Media Super Limited (ABN 30 059 502 948, AFSL 230254) as trustee of Media Super (ABN 42 574 421 650).

^There is $13.8 billion in lost and unclaimed super. Could any of it be yours?, https://ministers.treasury.gov.au/ministers/jane-hume-2020/media-releases/there-138-billion-lost-and-unclaimed-super-could-any-it-be

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter