According to the report by liquidator Adam Shepard of Dean-Willcocks Shepard, Octopus director Michael O’Hara blamed the collapse on three interlinked issues.

Octopus had been supplying clients in the financial sector so was hit by the combination of the GFC, the legislative change to allow online delivery of annual reports, and the fact its largest client had a fixed margin on all contracts, “which heavily impacted the company’s profit margins”.

The liquidator has also revealed that when the Sydney broker collapsed on 10 May, it had outstanding loans with related entities, with $1.6 million owed to Octopus by director Michael O’Hara and $458,000 owed by Science in Sports.

Shepard described Science in Sports as “a related entity” of Octopus; its directors were Michael O’Hara and former Octopus director Claire O’Hara.

The liquidator could not shed any more detail on the nature of the loans or where the money had gone.

Michael O’Hara would not comment when contacted by ProPrint.

Shepard’s report said it was unlikely creditors would get any money back because O’Hara claimed to have a net asset deficit of $638,000 and Science in Sports claimed to have a net asset deficit of $575,000, including the debt to Octopus.

Octopus’ loans to Michael O’Hara peaked at $2.2 million in the 2010-11 financial year. O’Hara then repaid $607,000 before the firm collapsed. However, Science in Sports was loaned another $44,000 during that time.

[Opinion: Don’t ignore warning signs of bad credit]

In the past, creditors had expressed confusion to ProPrint over how such a small firm with seemingly low capital requirements and only five staff could have such high overheads.

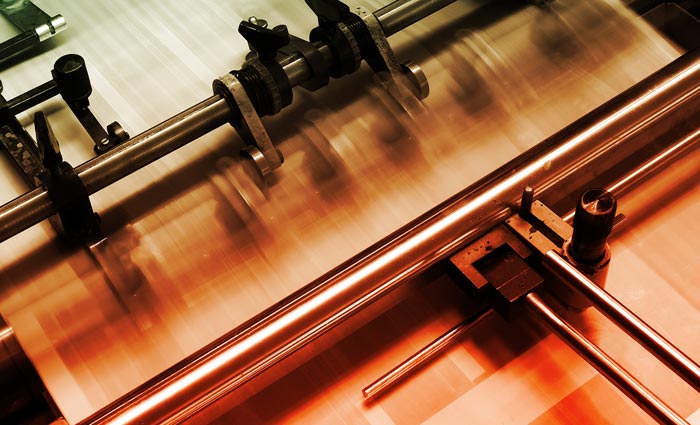

ProPrint now understands that Octopus was deriving about 30% of its revenue from digital printing by the time it collapsed – and that the move into production in 2009 and corresponding increase in capital requirements may have led to its failure.

Octopus had five-year leases on all its digital and finishing equipment. That prompted an unsuccessful attempt in 2011 to offload the digital business.

According to Shepard’s report, O’Hara “first realised the company’s profit margin was reducing” in August 2011.

Shepard said Octopus made an unsuccessful attempt in January to form a joint venture and held unsuccessful fundraising discussions with third parties between January and April.

[LinkedIn: should the industry stop operating on credit?]

Octopus Solutions Pty Ltd is in no way related to Octopus Productions Pty Ltd.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter