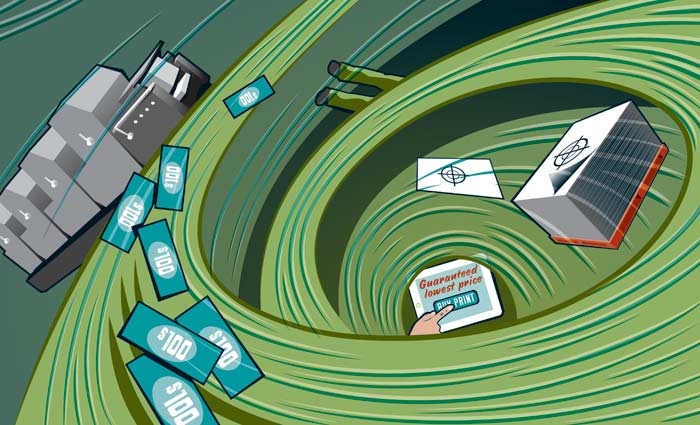

Online ordering portals are transforming the industry. These print broking or auction sites bring together panels of printers and let clients upload and order jobs online.

The companies behind online print management portals say they are making life easier for buyers while cutting costs for printers. They say they are ensuring consistency of service, quality and the long-term sustainability of the industry. They say it’s the future.

Printers are not convinced. They believe the business model is all about cutting prices – and cutting a printer’s profits. Some believe it’s a fad that won’t last.

Online portals play a similar role to print managers. But where print managers tend to go after major contracted clients such as government and banks, online portals take the same approach to the broader market. Online ordering via web-to-print is certainly not new: printers have been offering this to their clients for years. Nor is there anything landmark about selling to the broader market via the internet: Vistaprint in particular dominates this sector.

Developing trend

But online print broking is growing. Like so many internet commerce start-ups in other sector, they are leveraging our always-connected world to turn the web into a new marketplace for buying print.

Printingwatch, a company based in Texas, compares itself to kayak.com, which helps people select the cheapest flights. Company founder Sajid Hussein explains, “I was personally inspired to create it after finding it difficult to compare multiple printing companies online. Just search through the internet and you will hardly find any website that gives you the option to compare different printing companies.

“You only get to see the individual websites and big players that rely on huge marketing budgets, Adwords and Google SEO [search engine optimization] to get customers. So users normally see only those printing companies that have deep pockets to spend on advertising… small companies are completely wiped out from the scene and they hardly see any chance to compete with the big players.

“Printingwatch.com turns the tables around. It offers the option to consumers to price search and compare different printing companies based on the volume of printing they need and fine tune the search results as per their printing requirements. For example, a simple business cards search on Printingwatch will show you multiple companies from Australia who are offering these services.”

Printingwatch’s share of the local market is still tiny. For instance, a search for ‘business cards’ turns up 19 printers. The cheapest, Dark Horse, will do 1,000 for $48. The most expensive, Kanga Print, is $191. The panel largely comprises small players, but also features Officeworks, which offer 1,000 cards for $65.

Best in show

John Weichard announced PeoplePrint in 2012, with the operation launching properly this year. Weichard had form in this area, having started D2P “in the dotcom boom of 1998 on the premise of establishing an online network for delivering artwork for print”.

Weichard says PeoplePrint operates like online travel company Wotif. “Essentially in the same way if you wanted to book a motel room you go to Wotif and they show you the market for that particular spec you’re looking for,” Weichard says.

“PeoplePrint is the same. Someone is looking for, say, 2,000 full-colour brochures go to PeoplePrint and we will show them a list of specialists for that particular job.

“The jobs are pre-priced so the customer doesn’t have to go through the rigmarole of requesting six quotes and waiting 24 hours to get three back. They can see what they want there and then and buy it on the spot.”

Weichard says that in the first two weeks after his website opened, 270 printers applied to join. He now has a panel of around 15 printers and wants to build that.

Perhaps strangely, the names of these suppliers are hard to find. Instead, the print producers are badged under names like ‘PeoplePrint Orange Adelaide’ and ‘PeoplePrint Peach Canberra’.

Interested industry onlookers can have a fun game of Guess Who by trying to uncover the identities of suppliers such as PeoplePrint Gold Brisbane, which bills itself as “one of the largest privately owned printers based in Brisbane” that has recently achieved Level 3 environmental management system as well as colour management solution accreditation”. Meanwhile, PeoplePrint Green Sydney is billed as “Sydney’s largest family printing company”.

Weichard says PeoplePrint currently works in digital and offset and “will be adding large-format very soon”.

“It’s just a question of how quickly we can launch the products. We started off with brochures, flyers and booklets, then, in July, added postcards and envelopes as well. In the first month, we had more than 4,000 visitors. The site is tracking along quite well and exceeding our expectations.”

Weichard rejects suggestions he is undercutting printers. It’s quite the reverse, he claims. He insists the model actually helps printers by reducing their costs and, therefore, increasing their profits. PeoplePrint takes 10% of each job.

“It’s very efficient − we’ve taken a lot of the cost out of the job for printers. What we are seeing is that the printers are charging less but making more. The cost of processing a job is reduced because we are taking so many steps out of it and we are reducing the printer’s overheads in processing that job so their profit is up.”

He sees the model as the future of printing. “At the moment a pretty small percentage of print is bought online and printing is out of step with the rest of society,’’ he says. “As people like us and other companies are moving to remove those impediments, you’re going to see a big upsurge in the amount of printing that’s bought online.”

Agency appeal

Dotgain has a very different source of inspiration. It’s designed purely to work with advertising agencies and design studios. It has by far the best and most sophisticated site; what else would one expect from a company that works in agencyland? Co-founder Stuart Shepherd says online buying portals represent a model of the future. Dotgain is designed to save buyers time and money, he says.

“We were getting frustrated with sourcing print quotes and having to do it in the old manual way of picking up the phone and making calls or sending emails,” Shepherd says.

“It was a repetitive process; you had to do it three or four times. To get quotes from printers every time there is a new print job is time-consuming from an hour and headcount point of view.

“We wanted to look for a solution to that and the solution was Dotgain.”

Shepherd says printers on the Dotgain panels are carefully selected and the work focuses on four areas: web, sheetfed, large-format and digital. The clients they cater for are all design studios and agencies – no one else.

“It’s an industry tool; it’s not for consumers or companies. They have to be either an agency or a design studio that practises in the creative industry. It can’t be Joe Blow up the road or Telstra, for example. We feel printing direct is a conflict of interest, so it’s a trade tool and it’s for the creative industry.

“We want to encourage printers to change their focus from taking a sales-driven approach to adopting a more service-orientated approach. We would encourage them to keep their staff on and maintain that network and support but change the focus and discussion,” says Shepherd.

He says the printers with Dotgain are specialists. Their focus, he emphasises, is on quality and not price.

“The way it works is we have deliberately gone out to find the best printers in each of the states and there is a cap on that so it’s a maximum of 30 printers in total per state across four different categories,” he says. “It works out to be six or seven printers per category.”

The model’s strength might well come down to the way printers are selected.

“The print panel has been selected based on referral. The only way you can get to be on the print panel is you have to be referred by more than one agency,” Shepherd explains.

“We go out and meet with them. We have a look around their facilities, we ring around a few agencies and we find out what their background is. Once we are comfortable they can deliver on the promise that Dotgain is all about, then we are happy to have them on board.

“We think the printers we have selected are very competitive. We consider the printers we have are of exceptional quality and that’s the reason they are on the Dotgain network. We don’t envisage any of our printers are undercutting or undermining the print industry at all. That’s why they have been selected.”

Shepherd adds that the aim is to create something of quality for the design industry, not a print management company like Stream Solutions or Ergo. And he insists it’s not about price.

“There are no pricing wars. It has nothing to do with reducing the price of the industry. We have some core features that allow printers to understand the average of the market based on their price and the other printers’ prices.

“We believe our prices are competitive but we don’t believe it’s the bare bones. It’s not price driven. We are very supportive of making sure the printers are 100% being supported and getting paid what they deserve to be paid,” says Shepherd.

“It’s not a bidding system. A bidding system is a free for all where any printer can join and bid on any job they like and they can reduce or minimise the cost as much as they like. We minimise that by having a limited number of professional printers that are of a certain quality and standard and if they don’t meet that standard, then they get removed from the system.”

He sees it as the way of the future for the creative industry. “We see this tool being the way agencies and designers and creative industries will quote on a job. It will become the industry standard for the way a production manager will quote on the job.”

When printers receive jobs through Dotgain, they get the full amount for each job. The payment for Dotgain is a small percentage on the invoice.

Unsustainable

Printers, unsurprisingly, are not convinced. Arthur Heaps, owner of Sydney-based Print2Day, says all of these ordering portals are about squeezing the price. “It’s forcing competition between printers to drive the price down to get the work. That can’t be a good thing.”

Scott McInnes, director of Brisbane-based Shotz, says it would get in the way of printers developing relationships with their clients. And client relationships are the industry’s building blocks. “It is a profession and the client does not get the benefit of your knowledge.”

Jake Thomas, owner of Sydney-based Emroy Print & Design, says it’s a model designed to “make everyone bring their prices down to the floor”.

He says it is not sustainable and can’t see it being around for the future.

“It encourages everyone to compete on price alone, which may be good in the short term and might increase a few sales here and there, but you don’t build any loyalty with customers if you’re just getting them in on the price alone,” adds Thomas.

“Those customers only want a low price. The moment you can’t offer them a lower price, they will go somewhere else. It doesn’t matter how low you go, there will always be someone out there who can go lower than you can.

“It reminds me a lot of the group buying websites that everyone was making a big hoo-hah about when they launched. Here we are a couple of years later and I don’t think many of them are as successful as they were a few years ago. I think they might have a good run initially, but in the long term, customers get drawn in by low prices but then get turned off by low quality. They might work for a little while, but not for the long term.”

Andy Molloy, manager of the Little Print Shop in Perth, says he had worked on one print portal, Paperboys, and found it wasn’t suitable.

“Some of the prices for jobs were so varied and so random, and there was so little information regarding who the printer was and where it was coming from. As far as quality and knowing what you’re bidding against, you had no idea.

“I had a look at the jobs people were requesting and some of them were okay, but some were very small and they were getting ridiculously low quotes. They were paying less than normal.

“A lot of those prices were the bare bones minimum. If I worked out my cost price they were lower than that, but I would do that without knowing who these printers were. They might have even been a dummy bid to drive the price down. It’s not something a company can work with and remain in business.”

Deal with it

Molloy doesn’t see how this model would appeal to printers. “There are people who want to do that kind of thing and are happy to do it at cost to get work, but I think as far as the industry moving forward goes, if printers jump into that kind of service, then I don’t see how that’s going to help.”

But Printingwatch’s Hussein says the printers who moan about price cuts are just being self-serving.

“Price comparison is a universal phenomenon. When you look for flights, you compare price, when you shop you compare price online, when you book hotels you compare price from different providers. So why is the printing industry being so paranoid about this?

“For that, I have this simple answer: it’s because some companies see this model beating their monopoly and price tactics. Customers do have the right to get the best deal for their money; we just give them a chance to have one.”

Then again, printers know more about price pressures and rising costs than the portal operators. Indeed, they probably know more about these issues than most other industries.

Web age: ordering online

The internet drives print sales through a number of different models. Beyond print broking portals aimed at the broad market, there are three main examples:

Print management

Print managers, the politically correct name for print brokers, tend to be major logistics organisation that vie for the largest print contracts and tenders, including government, finance and retail. They pre-qualify panels of printers so that when clients place orders, clever automated software will send a request for proposal to the panel of suppliers, who can choose to bid.

Major players: Stream Solutions, Ergo, PMA Solutions, Blue Star IQ

B2c ordering

Search Google and you will find hundreds of companies offering web-to-print for the consumer market. These ordering sites tend to drive work back to a specific company, which produces it in-house or, in some cases, may outsource it via traditional trade partnerships.

Major players: Vistaprint, Snap, Kwik Kopy, Worldwide Online

Trade supply

Plenty of trade printers have closed online ordering platforms for their customers, who are generally other printers and graphic designers. They often specialise in certain commodity products, such as business cards, that can be produced cheaply by ‘ganging’ multiple orders onto single sheets. Industry ethics dictate that trade printers shouldn’t also print for end customers.

Major players: CMYKhub, Whirlwind, Hero Print, LEP

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter