Fairfax Media returns to profit in its 2017 full-year financial results, despite a decrease in revenue.

In its statutory results, the company achieved a net profit after tax of $83.9m, compared to its $772.6m loss in 2016, in which Fairfax took a $1bn write down of its publishing assets.

Underlying results show revenue is down 5.3 per cent from 2016, with a result of $1.7bn for the FY. EBITDA is also down, with a drop of 4.3 per cent from the pcp, at $271m, while EBIT is up eight per cent, sitting at $230m. With an underlying net profit after tax of $172m, Fairfax improved 7.6 per cent from the pcp.

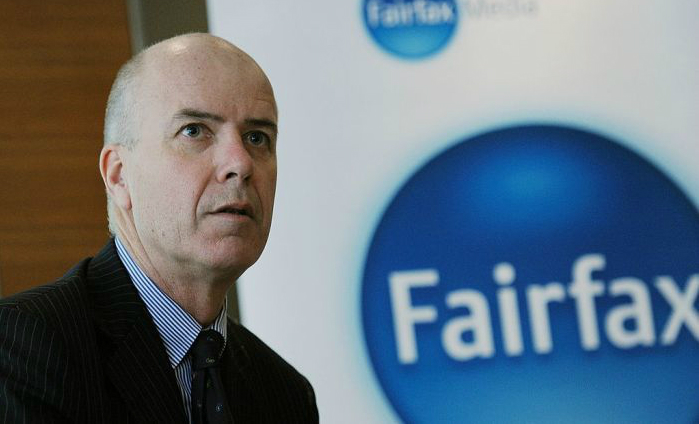

Greg Hywood, managing director, Fairfax says, “The strategy we commenced five years ago has successfully maximised cash flows of our publishing assets and with that built growth businesses in Domain and Stan.

“Domain delivered 19 per cent growth in digital revenue notwithstanding a difficult listings environment in the first half. As the listings cycle improved, H2 digital EBITDA increased 20 per cent.

“Our three publishing businesses are modern, cost efficient and sustainable across digital and print. In the context of the global structural change impacting upon the media industry, the fact that our publications remain profitable and sustainable is an outstanding achievement.”

Hywood acknowledges Fairfax’s metro advertising revenue declined 17 per cent from 2016, but says the company is working on creating new digital products while sustaining a successful print proposition.

“We are focusing editorial on distinctive content to strengthen our audience and subscriber proposition. The new products will drive engagement, subscriber value and better outcomes for advertisers through new data-driven commercial solutions and advertising formats. The introduction of the new tech platform will allow for the retirement of legacy systems and cost rebasing.”

While the 2016 annual report was foreshadowed by a potential move away from print, there was no such mention in the 2017 annual report.

The separate listing of Domain on the ASX has been confirmed, with Fairfax retaining 60 per cent, and 40 per cent being distributed to shareholders. It says regulatory clearances across ASIC, ASX and ATO are well advanced.

Hywood says, “Domain has created a strong platform for revenue growth, and is well positioned for a standalone future.

“Domain delivered 19 per cent growth in digital revenue. The transition to a digital business weighed on print revenue which declined 13 per cent for the year.

“For FY2018, Domain’s cost are expected to increase approximately 13 per cent from FY2017’s $206m.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@sprinter.com.au.

Sign up to the Sprinter newsletter